Today, we face the worst crisis in a long time. We defend our currency and fight for the stability of the Euro.

That is what our Federal Chancellor says.

Trichet, the boss of the European Central Bank, even goes so far as to say:

Europe is in the middle of the worst crisis since WW2.

The talk is about currency war. It sounds a lot like blood, sweat and tears and reminds me of Winston Churchill.

And you hear that the Euro fighters allegedly fight fiercely on various frontlines in the Euro country. Without rest, they are busy all the time stabilizing our currency. Against the evil gamblers.

They mobilize the last reserves and throw them at the Euro frontline. Using 500 virtual billions, they fight a virtual thread of 3,500 billion rotating on the world market. Incidentally, 1,000 billion are swapped – sorry, I mean traded – between Euros and Dollars each day.

Their comments sound like that of Greek fire-fighters during the phase of the all-consuming forest fires in the year 2008. After the struggle, they swore most sacred oaths that the financial world was going to underlie rigorous control from now on and that expenses will be cut down. And that the expense cuts will be monitored “from the top” by regulations and commissioners. Immediately afterwards, they start quarrelling about where to cut down expenses. Yet they cannot tame the financial world, because it is a global issue.

It is all ridiculous. A huge pile of totally unrealistic nonsense. Bullshit, as the shareholders would say among themselves.

What did really happen?

Nothing!

Nothing has changed. Just like the federal debt of the Federal Republic of Germany, the Greek debt did not grow overnight. The situation is the same as a few years or decades ago. There is no sudden change that might justify the current fit of hysterics.

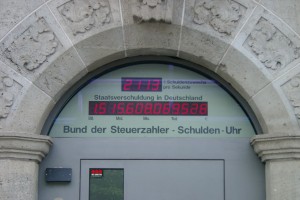

The digital “pointer” of the debt clock (Schuldenuhr), too, moves as usual. If it were to come to a standstill, this would be strange. But be not afraid, it will continue to rotate. The financial world is also the same as ten or twenty years ago. Banks play the same games. Quite a considerable part of our society and business live from it – incidentally all but poorly.

Everything is moving in the usual trot, as always. Well, maybe there was another zero added, but then, what is another zero?

Basically, nothing has happened. And nothing will happen. What goes around comes around. Similarly, the Euro will continue to work as long as it does. And when the time comes for the Euro to no longer be an option, another currency will replace it. That is what always happened with currency, and it will be the same in the future. Who cares if the new currency is installed 10 years earlier or later?

It is the same with countries. They borrow money until they go bankrupt. Then they start anew. That is what always happened and there is no reason why it should not be the same in the future. And it is part of the natural course of events that a time of “crash” is due.

Over the last 50 years, we did what countries and people have always done: we indebted ourselves. A crash is the logical consequence. And it is a historically proven method all educated people should be familiar with.

It is the same with currencies. The Deutsch Mark was good for more than 50 years. This is a record. The Euro has already been good for 10 years. Considering its wide range of circulation, this is not a poor result. After all, in former centuries, we had five crashes per century even with currencies that only covered a small area. That was an average of 20 years.

The crash is just a cleansing process of the financial world that happens and probably has to happen at regular intervals. It is like a thunder storm that cleans the air and the dusty roads after several hot summer days. After the rain, the wet clothes are dried and you continue with summer and partying. And just like the thunder storm does not hit all of us, so the crash, too, never hits all of us.

It is evident that a crash must cause change. And it is also clear that change breeds winners and losers. Consequently, everybody can see clearly that it takes some time to overcome a crash. But such is life. There is a reason why most people are so scared of change.

Money and currencies only exist virtually. As the wise Indian lady in “White Men” said: you cannot eat money. You cannot drink it either. In fact, it is not even very good for fuel. Love is also something you cannot get for money.

Unlike money and currencies, war or a traffic accident are not virtual. They cause real terror or death. And there is more misery in their wake than in the worst crash. Basically, it is the same as if you have a total write-off in traffic. As long as only the car is damaged, you were lucky indeed. So what? So: why are we so scared about the crash of a virtual construction such as the currency?

What is real are the other, really bad news: regimes that suppress people. Continents where people die of poverty, thirst, hunger and incurable deceases.

What is also real is the gigantic water consumption that threatens to minimize the world-wide reserves in the near future. The same is true for the CO2 proportion in our air that exceeds a dangerous mark which has been constant for 10 million years and may well have been the requirement for our life on this planet. What is also reality is the ruthless extinction of species, the flooding of land and oceans with plastic rubbish and the destruction of our world as a whole, both on a small scale and world-wide.

What currently happens in the Gulf of Mexico is also reality.

So, why don’t we just forget all the nonsense about the Euro and Greece. After all, it is just Bullshit. Instead, let us deal with the realities of this world

RMD

(Translated by EG)

P.S.

I decided to write this article after having talked with a very nice female bank consultant. As far as financial issues are concerned, the conversation really had a soothing effect on me.

P.S.1

The picture of the debt clock was taken by Wimox. I took it from Wikipedia, where Wimox published it under the GNU licence for free documentation (GNU-Lizenz für freie Dokumentation).

The picture of the debt clock was taken by Wimox. I took it from Wikipedia, where Wimox published it under the GNU licence for free documentation (GNU-Lizenz für freie Dokumentation).

The picture of Churchill is from the central media archive Wikimedia Commons.