“8% interest is too much for the Southern European nations“. – “If the Euro fails, Europe fails“. What pitiful sentences!

Yet the historical truth is so near. Firstly, the ratings of the Southern countries (and of others, too) were certainly wrong. The agencies gave their readers the wrong impression of security and should be admonished for it. But they certainly should not be admonished for now slowly approaching the truth.

As to the market: now, as they took off the blindfold, the players on the market want to get rewarded for the risk they took. Well, to be sure, this is now the only way to wake the political classes from their dreamy fantasies: I do not believe in < self-imposed moderation as Germany propagates it. But considering the moderation effect of interest rates, I would be quite optimistic.

A consequence of this would be that the gentlemen JunkerHollandeMontiundCo would not get interest assistance. But, ladies and gentlemen, feel free to put all your – certainly considerable – wealth into southern state government bonds.

A consequence of this would be that the gentlemen JunkerHollandeMontiundCo would not get interest assistance. But, ladies and gentlemen, feel free to put all your – certainly considerable – wealth into southern state government bonds.

Wouldn’t it be nice to be a mouse and listen? Which government bonds do Roth and Steinbrück buy? Do they really, out of sympathy, only buy those from Greece, Portugal and Spain? And then, when finally the entire mountain collapses, we will dance Sirtaki with Anthony Quinn: “Don’t be sad, dear boss, life is too short”.

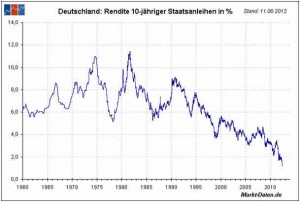

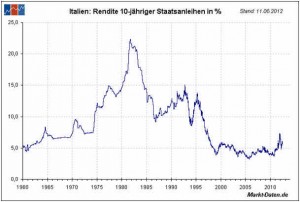

In order to show the truth about what nations can stomach and what they actually did stomach in the past, you can look at the figure below. It shows 10 years of government bonds and I took it from Markt-Daten.de.

In the past, many nations successfully coped with higher interest rates, for instance the FRG when we had to finance the re-unification. I remember well the malice at the financial centre of London when they saw our high interest rates – did any of them volunteer to help us finance them? No. All over the financial centre of London they were quite happy with the high German interest rates.

In the past, many nations successfully coped with higher interest rates, for instance the FRG when we had to finance the re-unification. I remember well the malice at the financial centre of London when they saw our high interest rates – did any of them volunteer to help us finance them? No. All over the financial centre of London they were quite happy with the high German interest rates.

But now let us enjoy the life of this summer, all the Junkers, Roths, Steinbrücks, Trittins and the other good people! This is the end of investment, the end of the film, Anthony Quinn and the duped financier. There is no alternative. Here we have life without old age, without civilization, living now and ignoring tomorrow… how thoroughly nice and absent-minded.

wl

(Translated by EG)